5 Reasons Why Social Media is the Future of Lending

By Full Editorial There was a time, not so long ago, when borrowing money was a formal, intimidating ritual. You put on your Sunday best, walked into a brick-and-mortar bank with marble floors, sat across a heavy oak desk from a stern loan officer, and hoped for the best. It was a process defined by gatekeepers, silence, and a lot of waiting. That world is effectively extinct.

Today, the financial journey doesn’t start with a handshake; it starts with a scroll. The modern borrower isn’t looking for a bank branch; they are looking for a solution that fits into their digital life. They are finding financial partners in the same place they find dinner recipes and vacation inspiration: social media.

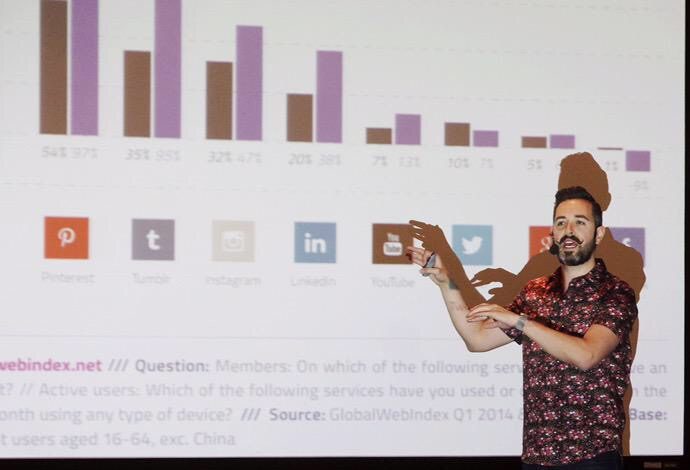

The shift is massive. Platforms like TikTok, Instagram, and Reddit have transformed from entertainment hubs into search engines. When a user realizes they need extra funds for a renovation or an emergency, they aren’t necessarily typing “banks near me” into Google. They are looking for recommendations from influencers, reading threads on financial subreddits, or clicking on targeted ads that pop up between stories. Whether they are looking for a mortgage or a quick online loan, the path to approval is now paved with likes, shares, and comments.

But why the shift? Why trust a platform known for cat videos with serious financial decisions? The answer lies in a fundamental change in how we consume trust and information. Here is why social media has become the new storefront for the lending industry.

1. The Death of the Corporate Facade

Consumers are tired of the corporate speak. Banks have spent decades hiding behind polished logos, confusing jargon, and terms and conditions pages that require a law degree to decipher. This created a trust deficit. We assume that if a bank is hiding in the fine print, they are trying to trick us.

Social media demands authenticity. On platforms like TikTok or Instagram Reels, a lending company can’t just post a stock photo of a smiling couple. They have to show their face. They have to explain their terms in a 60-second video.

When a consumer sees a real person explaining how interest rates work or breaking down the application process in plain English, it builds a bridge. It humanizes the lender. We are biologically wired to trust faces more than logos. By moving the conversation to social media, lenders are stepping out from behind the curtain, and consumers are rewarding that transparency with their business.

2. The Rise of “FinTok” and Peer Education

Finance used to be boring. Then came “FinTok” (Financial TikTok). Suddenly, budgeting, investing, and borrowing became viral content. Content creators started breaking down complex financial concepts into bite-sized, entertaining clips. This demystified the lending process for an entire generation.

Consumers turn to social media because it is an educational tool. Before they apply for a loan, they want to know the pros and cons. They want to know the difference between secured and unsecured loans. They don’t want to read a white paper; they want a two-minute explainer video.

Social media …read more

Source:: Social Media Explorer